Introduction to the ale package

Chitu Okoli

August 27, 2025

Source:vignettes/ale-intro.Rmd

ale-intro.RmdAccumulated Local Effects (ALE) were initially developed as a

model-agnostic approach for global explanations of the results of

black-box machine learning algorithms (Apley, Daniel W., and Jingyu Zhu.

‘Visualizing the effects of predictor variables in black box supervised

learning models.’ Journal of the Royal Statistical Society Series B:

Statistical Methodology 82.4 (2020): 1059-1086 doi:10.1111/rssb.12377).

ALE has at least two primary advantages over other approaches like

partial dependency plots (PDP) and SHapley Additive exPlanations (SHAP):

its values are not affected by the presence of interactions among

variables in a model and its computation is relatively rapid. This

package reimplements the original algorithm from the {ALEPlot}

package and reimplements the plotting of ALE values. It also extends

the original ALE concept to add bootstrap-based confidence intervals and

ALE-based statistics that can be used for statistical inference.

For more details, see Okoli, Chitu. 2023. “Statistical Inference Using Machine Learning and Classical Techniques Based on Accumulated Local Effects (ALE).” arXiv. doi:10.48550/arXiv.2310.09877.

This vignette demonstrates the basic functionality of the ale package on standard large datasets used for machine learning. A separate vignette is devoted to its use on small datasets, as is often the case with statistical inference. (How small is small? That’s a tough question, but as that vignette explains, most datasets of less than 2000 rows are probably “small” and even many datasets that are more than 2000 rows are nonetheless “small”.) Other vignettes introduce ALE-based statistics for statistical inference and show how the ale package handles various datatypes of input variables.

We begin by loading the necessary libraries.

library(ale)

#>

#> Attaching package: 'ale'

#> The following object is masked from 'package:base':

#>

#> get

library(dplyr)

#>

#> Attaching package: 'dplyr'

#> The following objects are masked from 'package:stats':

#>

#> filter, lag

#> The following objects are masked from 'package:base':

#>

#> intersect, setdiff, setequal, uniondiamonds dataset

For this introduction, we use the diamonds dataset,

included with the ggplot2 graphics system. We cleaned the

original version by removing duplicates and

invalid entries where the length (x), width (y), or depth (z) is 0.

# Clean up some invalid entries

diamonds <- ggplot2::diamonds |>

filter(!(x == 0 | y == 0 | z == 0)) |>

# https://lorentzen.ch/index.php/2021/04/16/a-curious-fact-on-the-diamonds-dataset/

distinct(

price, carat, cut, color, clarity,

.keep_all = TRUE

) |>

rename(

x_length = x,

y_width = y,

z_depth = z,

depth_pct = depth

)

summary(diamonds)

#> carat cut color clarity depth_pct

#> Min. :0.2000 Fair : 1492 D:4658 SI1 :9857 Min. :43.00

#> 1st Qu.:0.5200 Good : 4173 E:6684 VS2 :8227 1st Qu.:61.00

#> Median :0.8500 Very Good: 9714 F:6998 SI2 :7916 Median :61.80

#> Mean :0.9033 Premium : 9657 G:7815 VS1 :6007 Mean :61.74

#> 3rd Qu.:1.1500 Ideal :14703 H:6443 VVS2 :3463 3rd Qu.:62.60

#> Max. :5.0100 I:4556 VVS1 :2413 Max. :79.00

#> J:2585 (Other):1856

#> table price x_length y_width

#> Min. :43.00 Min. : 326 Min. : 3.730 Min. : 3.680

#> 1st Qu.:56.00 1st Qu.: 1410 1st Qu.: 5.160 1st Qu.: 5.170

#> Median :57.00 Median : 3365 Median : 6.040 Median : 6.040

#> Mean :57.58 Mean : 4686 Mean : 6.009 Mean : 6.012

#> 3rd Qu.:59.00 3rd Qu.: 6406 3rd Qu.: 6.730 3rd Qu.: 6.720

#> Max. :95.00 Max. :18823 Max. :10.740 Max. :58.900

#>

#> z_depth

#> Min. : 1.070

#> 1st Qu.: 3.190

#> Median : 3.740

#> Mean : 3.711

#> 3rd Qu.: 4.150

#> Max. :31.800

#> Here is the description of the modified dataset.

| Variable | Description |

|---|---|

| price | price in US dollars ($326–$18,823) |

| carat | weight of the diamond (0.2–5.01) |

| cut | quality of the cut (Fair, Good, Very Good, Premium, Ideal) |

| color | diamond color, from D (best) to J (worst) |

| clarity | a measurement of how clear the diamond is (I1 (worst), SI2, SI1, VS2, VS1, VVS2, VVS1, IF (best)) |

| x_length | length in mm (0–10.74) |

| y_width | width in mm (0–58.9) |

| z_depth | depth in mm (0–31.8) |

| depth_pct | total depth percentage = z / mean(x, y) = 2 * z / (x + y) (43–79) |

| table | width of top of diamond relative to widest point (43–95) |

str(diamonds)

#> tibble [39,739 × 10] (S3: tbl_df/tbl/data.frame)

#> $ carat : num [1:39739] 0.23 0.21 0.23 0.29 0.31 0.24 0.24 0.26 0.22 0.23 ...

#> $ cut : Ord.factor w/ 5 levels "Fair"<"Good"<..: 5 4 2 4 2 3 3 3 1 3 ...

#> $ color : Ord.factor w/ 7 levels "D"<"E"<"F"<"G"<..: 2 2 2 6 7 7 6 5 2 5 ...

#> $ clarity : Ord.factor w/ 8 levels "I1"<"SI2"<"SI1"<..: 2 3 5 4 2 6 7 3 4 5 ...

#> $ depth_pct: num [1:39739] 61.5 59.8 56.9 62.4 63.3 62.8 62.3 61.9 65.1 59.4 ...

#> $ table : num [1:39739] 55 61 65 58 58 57 57 55 61 61 ...

#> $ price : int [1:39739] 326 326 327 334 335 336 336 337 337 338 ...

#> $ x_length : num [1:39739] 3.95 3.89 4.05 4.2 4.34 3.94 3.95 4.07 3.87 4 ...

#> $ y_width : num [1:39739] 3.98 3.84 4.07 4.23 4.35 3.96 3.98 4.11 3.78 4.05 ...

#> $ z_depth : num [1:39739] 2.43 2.31 2.31 2.63 2.75 2.48 2.47 2.53 2.49 2.39 ...

summary(diamonds$price)

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> 326 1410 3365 4686 6406 18823Interpretable machine learning (IML) techniques like ALE should be applied on the same dataset that was used to train the model. An explanation is an explanation of a trained model and a trained model is intrinsically linked to the dataset on which it is trained. (When a dataset is too small to feasibly split into training and test sets, then the ale package has tools to appropriately handle such small datasets.

Modelling with generalized additive models (GAM)

ALE is a model-agnostic IML approach, that is, it works with any kind of machine learning model. As such, ale works with any R model with the only condition that it can predict numeric outcomes (such as raw estimates for regression and probabilities or odds ratios for classification). For this demonstration, we will use generalized additive models (GAM), a relatively fast algorithm that models data more flexibly than ordinary least squares regression. It is beyond our scope here to explain how GAM works (you can learn more with Noam Ross’s excellent tutorial), but the examples here will work with any statistical or machine learning algorithm.

We train a GAM model to predict diamond prices:

# Create a GAM model with flexible curves to predict diamond prices.

# Smooth all numeric variables and include all other variables.

gam_diamonds <- mgcv::gam(

price ~ s(carat) + s(depth_pct) + s(table) + s(x_length) + s(y_width) + s(z_depth) +

cut + color + clarity,

data = diamonds

)

summary(gam_diamonds)

#>

#> Family: gaussian

#> Link function: identity

#>

#> Formula:

#> price ~ s(carat) + s(depth_pct) + s(table) + s(x_length) + s(y_width) +

#> s(z_depth) + cut + color + clarity

#>

#> Parametric coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 4436.199 13.315 333.165 < 2e-16 ***

#> cut.L 263.124 39.117 6.727 1.76e-11 ***

#> cut.Q 1.792 27.558 0.065 0.948151

#> cut.C 74.074 20.169 3.673 0.000240 ***

#> cut^4 27.694 14.373 1.927 0.054004 .

#> color.L -2152.488 18.996 -113.313 < 2e-16 ***

#> color.Q -704.604 17.385 -40.528 < 2e-16 ***

#> color.C -66.839 16.366 -4.084 4.43e-05 ***

#> color^4 80.376 15.289 5.257 1.47e-07 ***

#> color^5 -110.164 14.484 -7.606 2.89e-14 ***

#> color^6 -49.565 13.464 -3.681 0.000232 ***

#> clarity.L 4111.691 33.499 122.742 < 2e-16 ***

#> clarity.Q -1539.959 31.211 -49.341 < 2e-16 ***

#> clarity.C 762.680 27.013 28.234 < 2e-16 ***

#> clarity^4 -232.214 21.977 -10.566 < 2e-16 ***

#> clarity^5 193.854 18.324 10.579 < 2e-16 ***

#> clarity^6 46.812 16.172 2.895 0.003799 **

#> clarity^7 132.621 14.274 9.291 < 2e-16 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Approximate significance of smooth terms:

#> edf Ref.df F p-value

#> s(carat) 8.695 8.949 37.027 < 2e-16 ***

#> s(depth_pct) 7.606 8.429 6.758 < 2e-16 ***

#> s(table) 5.759 6.856 3.682 0.000736 ***

#> s(x_length) 8.078 8.527 60.936 < 2e-16 ***

#> s(y_width) 7.477 8.144 211.202 < 2e-16 ***

#> s(z_depth) 9.000 9.000 16.266 < 2e-16 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> R-sq.(adj) = 0.929 Deviance explained = 92.9%

#> GCV = 1.2602e+06 Scale est. = 1.2581e+06 n = 39739

ALE object for ALE data

The core object in the ale package is the

S7 ALE object. effect stores

the ALE data and, optionally, ALE statistics and bootstrap data for one

or more categories. The first argument to the ALE()

constructor is a model object–any R model object that can generate

numeric predictions is acceptable. By default, it generates 1D (or

“first order”) ALE on all the variables in the dataset that was used to

train the model, if the dataset is included in the model object. If not,

the dataset can be specified with the data argument. It can

optionally create ALE only for specified variables and interactions

using the x_cols argument. To change these options (e.g.,

to calculate ALE for only a subset of variables; to output the data only

or to use a custom predict function for the model), see details in the

help file for the object: help(ALE). In this introduction,

we only demonstrate The basics of retrieving and plotting ALE data. For

details on ALE statistics see the dedicated vignette on that

topic.

# For faster processing, you can enable parallel processing: set the number of CPU cores available. See help(ALE) for details.

options(ale.parallel = 2)For faster demonstrations, this vignette uses precreated ALE objects. For the full experience, you can uncomment the relevant lines in the code below.

# For speed, these examples use retrieve_rds() to load pre-created objects

# from an online repository.

# To run the code yourself, execute the code blocks directly.

serialized_objects_site <- "https://github.com/tripartio/ale/raw/main/download"

# Simple ALE without bootstrapping

# Create ALE data

# # To run the slow code yourself, uncomment and execute this code block directly.

# # For models like mgcv::gam that store their data,

# # there is no need to specify the data argument.

# ale_gam_diamonds <- ALE(gam_diamonds)

ale_gam_diamonds <- serialized_objects_site |>

file.path("ale_gam_diamonds.0.5.2.rds") |>

url() |>

readRDS()Most core functions in the ale package support

parallel processing. You can enable parallelization globally with

options(ale.parallel = x), where “x” is the number of CPU

cores you want to use. It can also be enabled for specific function runs

with the parallel argument. Parallelization is disabled by

default with parallel = 0. See the documentation for

ALE() for details.

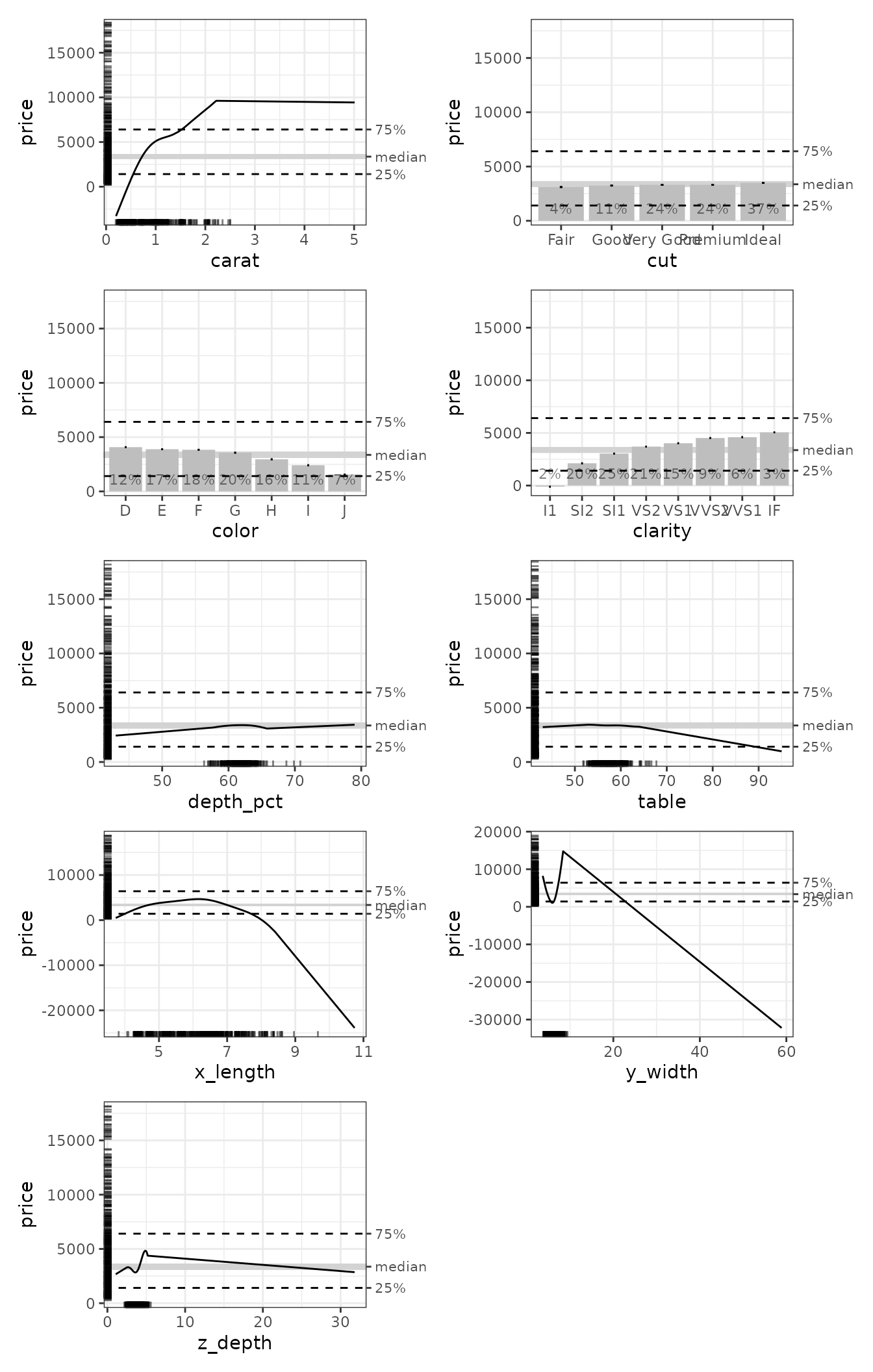

To access the plot for a specific variable, we must first create an

ALEPlots object by calling the plot() method

on the ALE object which internally generates

ggplot objects with the full flexibility of {ggplot2}:

# Print a plot by entering its reference

diamonds_plots <- plot(ale_gam_diamonds)To retrieve a specific variable plot, you can use the

get() method of the ALEPlots object. For

example, to access and print the carat ALE plot, we can

simply refer to get(diamonds_plots, 'carat'):

# Print a plot by entering its reference

get(diamonds_plots, 'carat')

To display all the ALE plots in an ALEPlots object, we

can simply call its print() or plot() methods.

Behind the scenes, they use the patchwork package to

arrange multiple plots in a common plot grid using

patchwork::wrap_plots(), so we can pass arguments from that

function. For example, we can specify that we want two plots per row

with the ncol argument:

# Print all plots

plot(diamonds_plots, ncol = 2)

Bootstrapped ALE

One of the key features of the ALE package is bootstrapping of the

ALE results to ensure that the results are reliable, that is,

generalizable to data beyond the sample on which the model was trained.

As mentioned above, this assumes that IML analysis is carried out on a

model whose hyperparameters were determined by cross-validation. When

samples are too small for cross-validation, we provide a different

approach by bootstrapping the entire model with a ModelBoot

object, explained in the vignette for small datasets.

Although ALE is faster than most other IML techniques for global explanation such as partial dependence plots (PDP) and SHAP, it still requires some time to run. Bootstrapping multiplies much of that time by the number of bootstrap iterations.

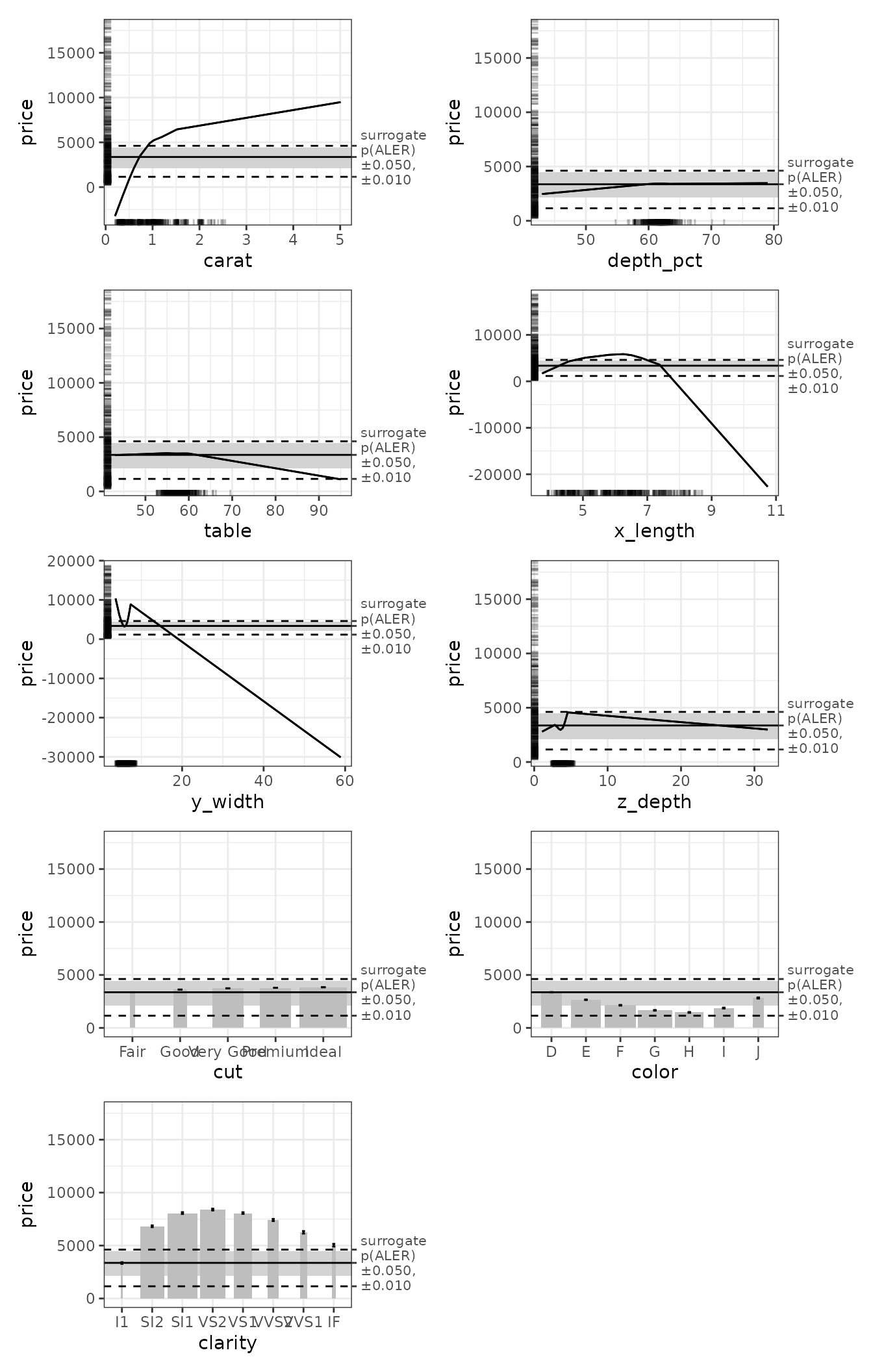

We create bootstrapped ALE data and plots using the

boot_it argument. ALE is a relatively stable IML algorithm

(compared to others like PDP), so 100 bootstrap samples should be

sufficient for relatively stable results, especially for model

development. Final results could be confirmed with 1000 bootstrap

samples or more, but there should not be much difference in the results

beyond 100 iterations.

# # To run the slow code yourself, uncomment and execute this code block directly.

# # For models like mgcv::gam that store their data,

# # there is no need to specify the data argument.

# ale_gam_diamonds_boot <- ALE(

# gam_diamonds,

# boot_it = 100

# )

ale_gam_diamonds_boot <- serialized_objects_site |>

file.path('ale_gam_diamonds_boot.0.5.2.rds') |>

url() |>

readRDS()

# Bootstrapping produces confidence intervals

plot(ale_gam_diamonds_boot) |>

print(ncol = 2)

In this case, the bootstrapped results are mostly similar to single

(non-bootstrapped) ALE results. In principle, we should always bootstrap

the results and trust only in bootstrapped results. The most unusual

result is that values of x_length (the length of the

diamond) from 6.2 mm or so and higher are associated with lower diamond

prices. When we compare this with the y_width value (width

of the diamond), we suspect that when both the length and width (that

is, the size) of a diamond become increasingly large, the price

increases so much more rapidly with the width than with the length that

the width has an inordinately high effect that is tempered by a

decreased effect of the length at those high values. This would be worth

further exploration for real analysis, but here we are just introducing

the key features of the package.

ALE interactions

Another advantage of ALE is that it provides data for 2D interactions

between variables. This is also implemented with the ALE()

constructor. When the d2 element of the x_cols

list argument is set to TRUE, ALE() generates

ALE data on all possible 2D interactions from the input dataset. To

change the default options (e.g., to calculate interactions for only

certain pairs of variables), see details in the help file for the

object: help(ALE).

# ALE two-way interactions

# # To run the slow code yourself, uncomment and execute this code block directly.

# ale_2D_gam_diamonds <- ALE(

# gam_diamonds,

# x_cols = list(d2 = TRUE)

# )

ale_2D_gam_diamonds <- serialized_objects_site |>

file.path('ale_2D_gam_diamonds.0.5.2.rds') |>

url() |>

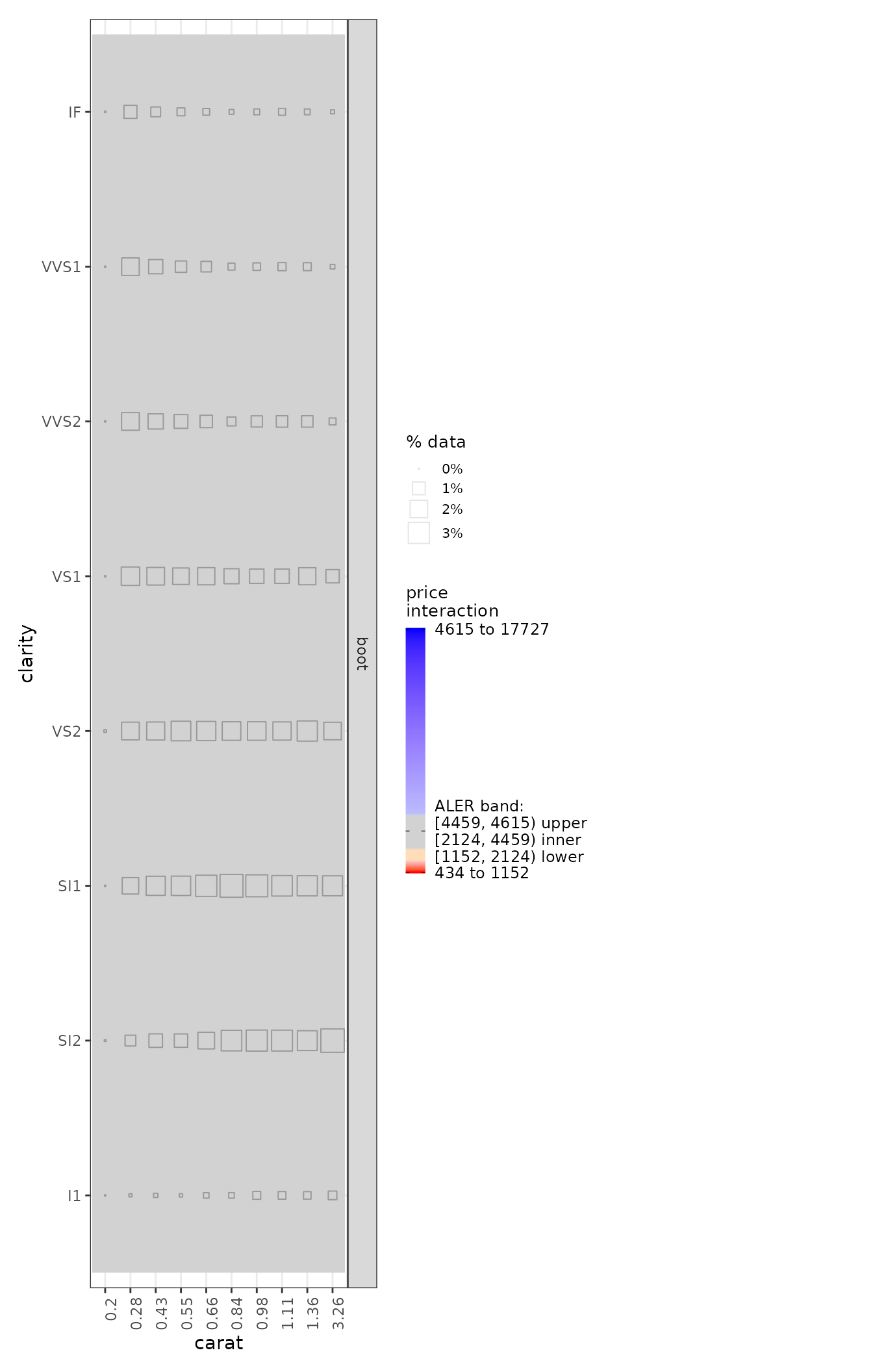

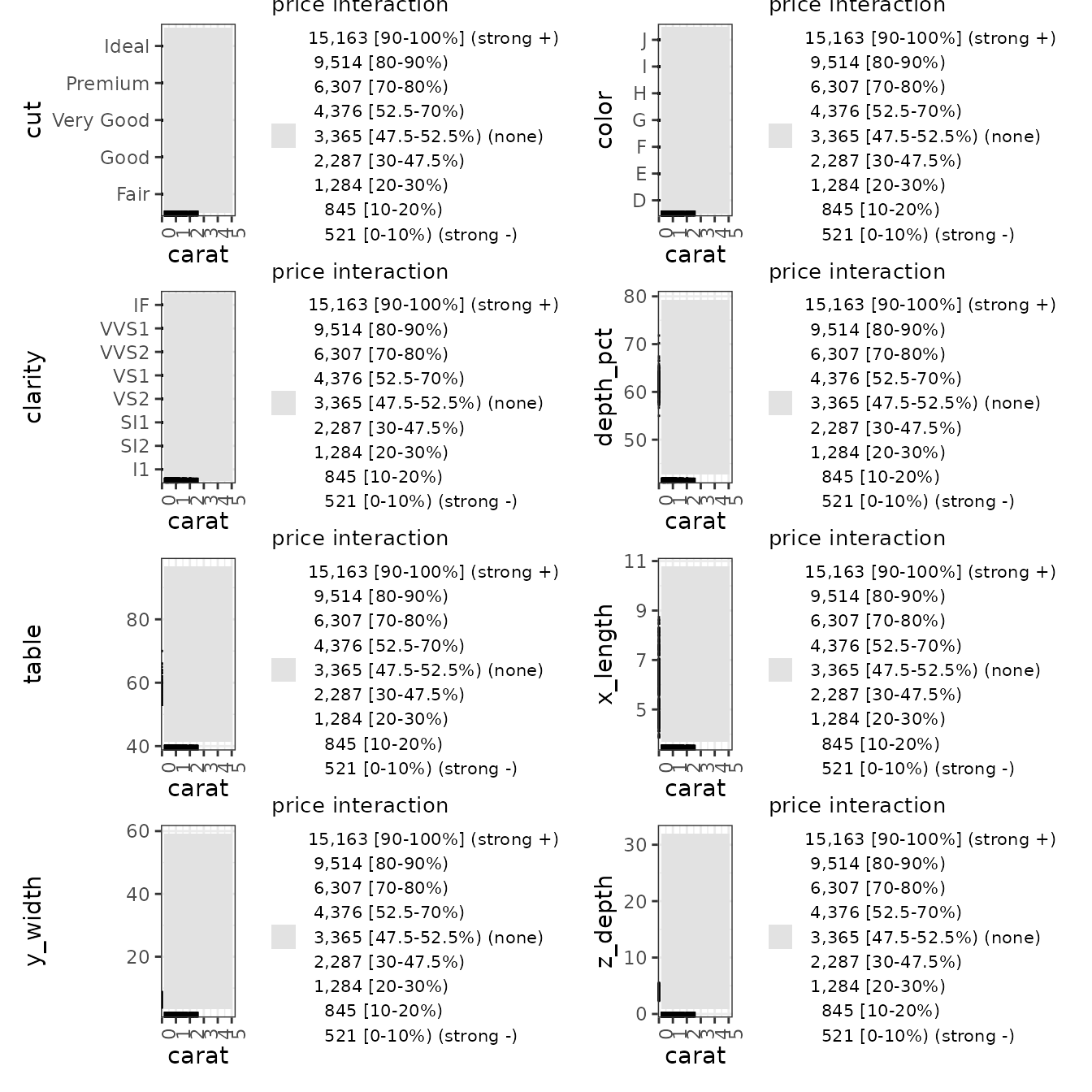

readRDS()The plot() method similarly creates 2D ALE plots from

the ALE object. The subset() method of

ALEPlots extracts a new ALEPlots object with

only the selected variables or interaction terms:

diamonds_2D_plots <- plot(ale_2D_gam_diamonds)

diamonds_2D_plots |>

# Select all 2D interactions that involve 'carat'

subset(list(d2_all = 'carat')) |>

print(ncol = 2)

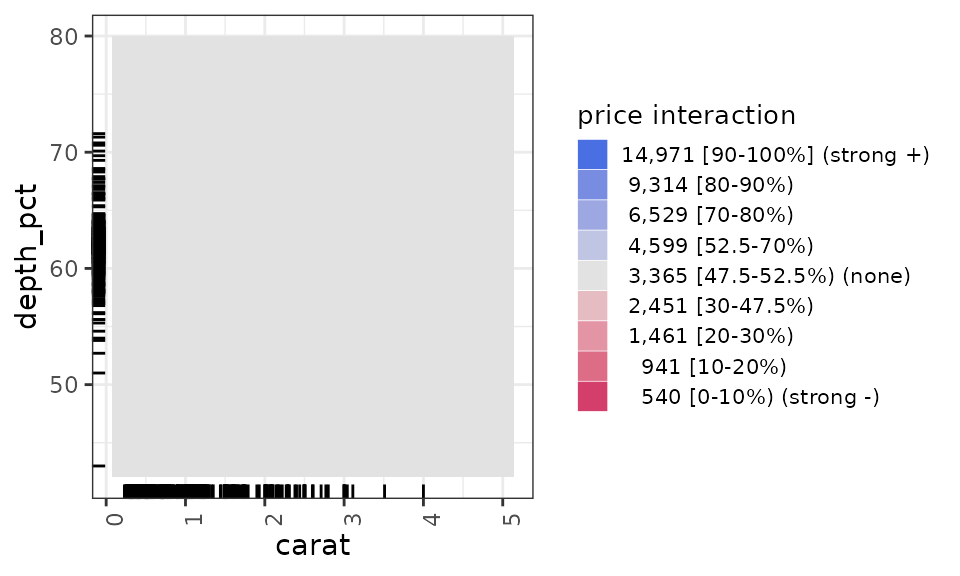

Because we are printing all plots together, some of them might appear

vertically distorted because each plot is forced to be of the same

height. For more fine-tuned presentation, we would need to refer to a

specific plot. The ale package supports the standard R

formula notation for specifying variables. For example, we can print the

interaction plot between carat and depth by referring to it thus:

get(diamonds_2D_plots, ~ carat:clarity).

get(diamonds_2D_plots, ~ carat:clarity)

This is not the best dataset to use to illustrate ALE interactions because there are none here. This is expressed in the graphs by the ALE y values all being grey, the middle range of data. In the plots, the darker squares indicate the relative percentage of actual data in each interaction intersection. So, there is very little actual data for 0.2 carats; there is much more higher carat ranges.

Note that ALE interactions are very particular: an ALE interaction

means that two variables have a composite effect over and above their

separate independent effects. So, of course x_length and

y_width both have effects on the price, as the one-way ALE

plots show, but their interaction has no additional composite

effect.